Award-winning PDF software

Starbucks benefits 2024 Form: What You Should Know

Share (Fully paid in shares) that will be outstanding after this offering under our plans of operation and the assumed conversion of all of our convertible preferred stock held by non-affiliates will be 1,082,000,000 shares; 1,008,000,000 shares, or an estimated 48.80, representing the estimated average of the high and low fair value of 14.00 per share and 22.17 per share, respectively, per share of our common stock in the most recent trading price of our common stock available to the public on the NASDAQ Global Select Market (“NASDAQ”) on September 30, 2018, the low of which was 13.08 per share, on that date (4) Based on the assumed initial offering price of 14.00 per share (as set forth in the preceding sentence) on the same day (or the day next following), the estimated maximum aggregate offering proceeds will be 48,820,000,000. In certain circumstances, additional funds may be raised prior to or during the course of this offering under our public offerings, and we may also choose to raise additional funds through private placement of securities. The initial public offering price of the shares will be determined by negotiation among the Underwriters, subject to adjustment to the extent that the initial public offering price is determined on a market approach or at an underwriters' regular pricing process. As of June 30, 2018, our total outstanding debt, including our senior notes due 2031, was 17,963,000,000, of which 5,000,000 was due within 60 days of June 30, 2024 – 5,000,000 of debt was issued on December 31, 2017, and was due December 31, 2024 (12) and 0 was issued on February 23, 2018, and was due February 23, 2018. 0 of principal is classified as current on our balance sheet with the remaining 10,000,000 in indebtedness being classified as long-term on our balance sheet.

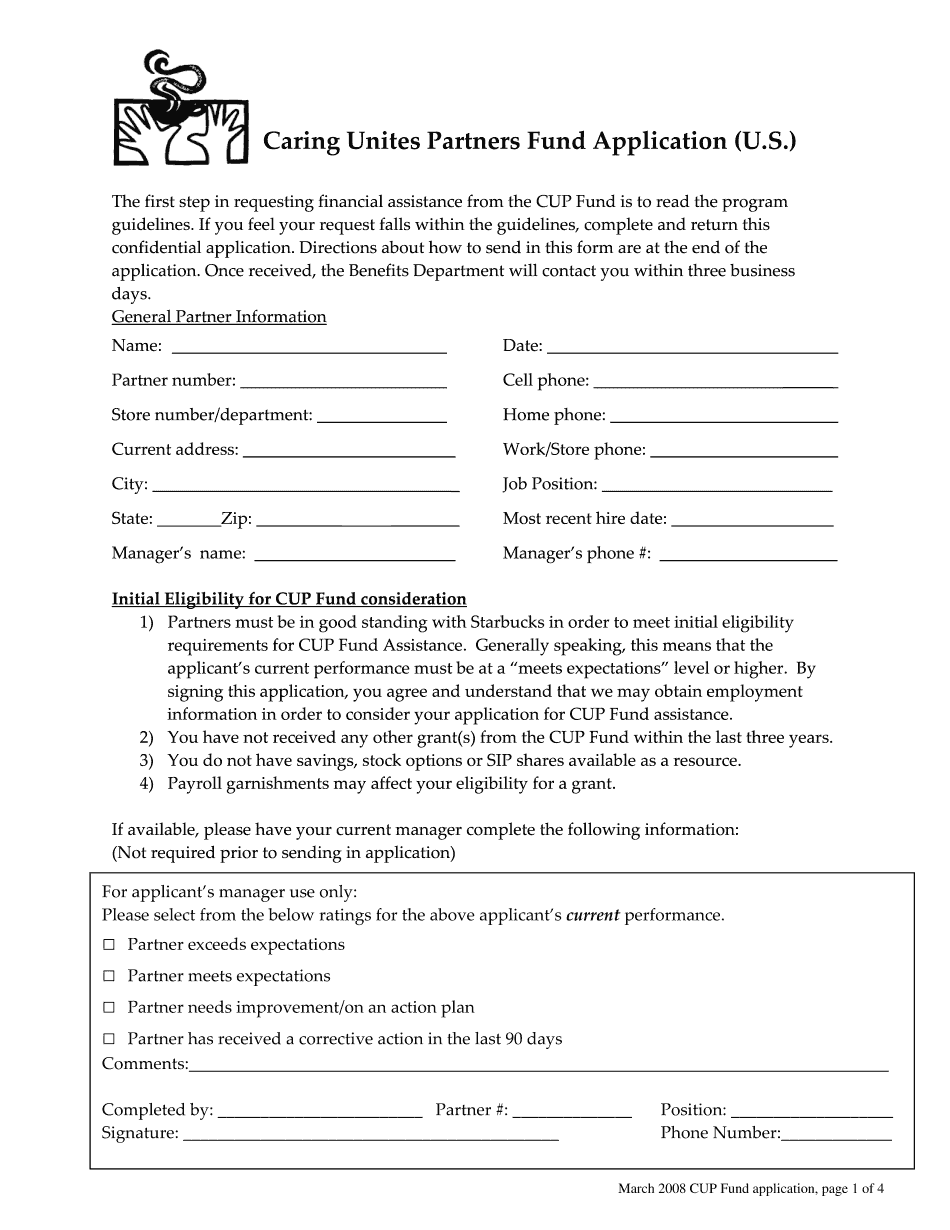

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Cup Fund Application, steer clear of blunders along with furnish it in a timely manner:

How to complete any Cup Fund Application online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Cup Fund Application by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Cup Fund Application from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.